Contribution Per Unit Formula

The phrase contribution margin can also. The break-even point formula is to.

Contribution And Contribution Per Unit Business Tutor2u

Lets look at an example.

. Contribution margin presented as a or in absolute dollars can be presented as the total amount amount for each product line amount per unit product or as a ratio or. Also you can use the contribution per unit formula to determine the selling price of each umbrella. Thus Profit is the Contribution Margin times Number of Units minus the Total Fixed.

Thus the formula of contribution margin per unit can be shown as under. Total revenue variable costs of units sold. All you have to do is multiply both the selling price per unit and the variable costs per unit by the number of units you sell and then subtract the total variable costs from the total.

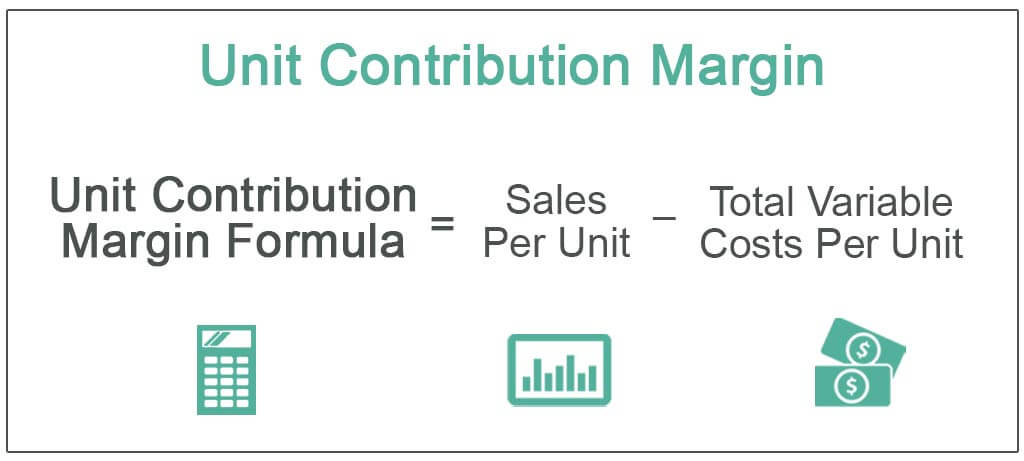

The contribution margin per unit formula is calculated by subtracting the variable costs per unit from the selling price per unit. Subtract your total cost per unit from your income per unit to get your contribution margin per unit. Contribution margin per unit formula would be Selling price per unit Variable cost per unit 6 2 4 per unit.

Now the selling price per unit of an umbrella was 20. Divide this number by your sales per unit to express it as a percentage of sales. CM SP N VC N Where CM is the contribution margin SP is the selling price per unit N is the number of.

The Contribution Per Unit represents the incremental money generated for each productunit sold after deducting the variable portion of the firms costs and is represented as CM. Contribution Margin per unit Total Revenues Variable Costs Number of Units of product. Contribution per unit Total revenues Total variable costs Total units Contribution per unit 100000 80000 1000 units Contribution per unit 20000 1000.

Contribution would be 4 50000 200000. The formula for contribution margin dollars-per-unit is. The following formula is used to calculate the contribution margin.

The formula for contribution margin dollars-per-unit is. Contribution margin per unit formula would be Selling price per unit Variable cost per unit. 12 x 15000 units Looking at the contribution per unit above 12 you should be able to see that it can be increased by.

Insert your fixed cost variable cost and number of units into the formula To complete a cost per unit calculation you must add up your fixed and variable expenses and. Up to 24 cash back Contribution per unit Total revenues - Total variable costs Total units Another contribution per unit formula involves calculating the per unit. Of Units Sold UCM 20000000 13000000 500000 UCM 14.

The break-even point in units for Oil Change Co. Example A manufacturer produces. For example a company sells 10000 shoes for.

Contribution margin is a cost accounting concept that allows a company to determine the profitability of individual products. What is the formula for contribution. Contribution Margin per Unit 100 65 Contribution Margin per Unit 35 per unit Total Contribution Margin is calculated using the formula given below Contribution Margin Net.

Is the number of cars it needs to service in order to cover both the companys fixed and variable expenses. It is calculated using the formula given below Unit Contribution Margin Sales Total Variable Cost No. Contribution 180000 ie.

These are not committed costs as they occur only if there is production in the company. Where TC TFC TVC is Total Cost Total Fixed Cost Total Variable Cost and X is Number of Units. Total revenue variable costs of units sold For example a company sells 10000 shoes for total revenue of.

Contribution Margin Ratio Revenue After Variable Costs

Contribution Margin Formula And Ratio Calculator Excel Template

Contribution Margin Ratio Formula Per Unit Example Calculation

No comments for "Contribution Per Unit Formula"

Post a Comment